In the heat of the holiday online shopping rush, retailers face persistent challenges such as increased web traffic or cyber threats that can lead to high-impact outages. With profit margins under high pressure, retailers are prioritizing strategic investments to help drive business value while improving the customer experience.

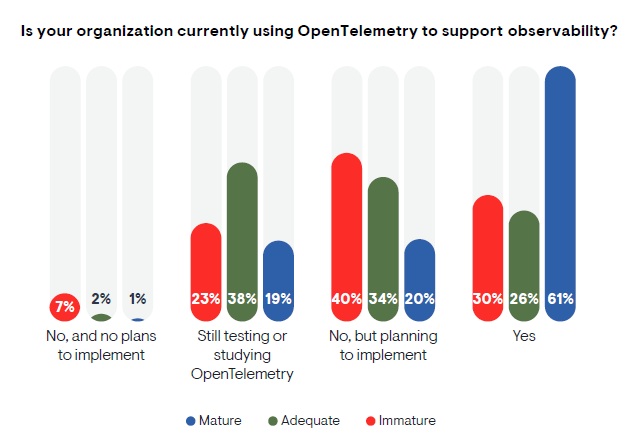

Published in October, New Relic's 2024 Observability Forecast Report reveals insights into key growth areas, challenges, and trends shaping the observability industry. The report surveyed IT professionals across numerous geographic locations and demographics to inform the understanding of the current state of observability. Of the 1,700 technology professionals surveyed, 148 were associated with the retail industry and consumer-centric sectors.

This November, New Relic published the State of Observability for Retail Report to share insights about observability's adoption and business impact across the retail industry and consumer-centric sectors.

Here are five key lessons learned from the report:

1. Observability helps retailers respond to outages faster and maintain positive business outcomes

Retailers that utilize observability to deliver business value gain an edge over their competitors. As retail organizations prepare for heightened demand during shopping periods like Black Friday and Cyber Monday, observability solutions help them tackle daily challenges, from mitigating application downtime to optimizing the online customer journey.

The forecast revealed that retailers experienced IT outages with a median annual downtime of 164 hours — or about one week. Though this is 41% lower than other industries, outages can cost organizations up to $1.9 million for every hour of downtime.

However, adopting alerts (62%) and network monitoring (59%) has helped retailers respond better to outages, with a median MTTD (mean-time-to-detection) of only 32 minutes. Further, improvements in network monitoring resulted in only 27% of respondents experiencing high-impact outages weekly. Adopting observability tooling has helped retail organizations maintain positive business outcomes and enhanced customer satisfaction.

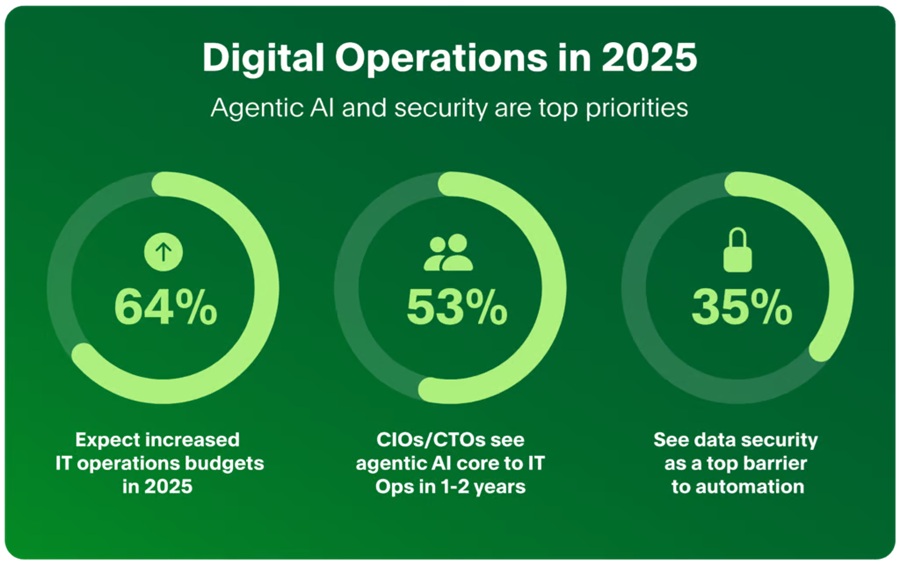

2. AI, IoT, and security are driving retailers to adopt observability

In a year of growth, just under half (46%) of retail organizations indicated that an increased focus on security, governance, risk, and compliance was the top technology strategy influencing observability adoption.

Additionally, as AI continues on its meteoric rise, it has remained a significant driver of observability adoption, with 39% of retail respondents identifying AI as a key reason to adopt observability. This trend reflects the sector's commitment to leveraging AI for multiple facets of their work, such as enhancing decision-making and deriving actionable customer insights.

Finally, retail organizations cited IoT as the third most popular driver of observability adoption (32%), underscoring the sector's desire to harness observability for operational excellence.

3. Digital Experience Monitoring (DEM) is on the rise

A large uptick in online shopping has led to an evolved customer journey, meaning digital experience monitoring (DEM) is now a key growth area among retail organizations. DEM combines real user monitoring (RUM) — which covers browser and mobile monitoring — with synthetic monitoring for proactive testing and improvement.

More than half of the respondents (52%) noted that they are preparing to deploy synthetic monitoring within three years, 49% anticipate deploying mobile monitoring, and 42% plan to implement browser monitoring to continue to optimize the online customer journey.

4. The journey to full-stack observability requires tool consolidation

Retail organizations have their sights set on achieving full-stack observability. Though just 18% of organizations have reached this key milestone, retailers are taking strategic steps to overcome issues like an influx of monitoring tools and siloed data, which 35% of retailers identified as major roadblocks on their journey to achieving full-stack observability.

However, some retailers are transitioning through tool consolidation, with retail organizations now using 4.4 tools on average, down from 5.4 in 2023, compared to the broader industry average of 4.5 tools. This proactive tool consolidation effort will support retailers on their way to full-stack observability, with nearly half (43%) of the organizations surveyed planning to further consolidate their observability investments within the next year to access more operational efficiency and maximize their ROI.

5. Investment in observability pays off

Retail organizations reported stronger investments in observability on average, with 74% of respondents indicating annual spending of $1 million or more, while just 2% allocated less than $100,000. This investment delivers significant returns, with retail organizations achieving a median annual return on investment (ROI) of 302%, which is 4x their spending. This further underscores the strategic value of observability in this sector.

In terms of benefits, just under half of respondents (48%) reported improvements in overall system uptime and reliability, while 43% reported a reduction in security risks. Other key benefits called out included operational efficiency (38%), developer productivity (37%), and enhanced customer experience (37%).