The financial services industry (FSI) is poised to take the next steps in using AI as a tool to drive business growth, improve operations and deliver a better digital experience for users. However, before taking full advantage of AI's capabilities, leaders first must address several readiness issues as well as concerns over data confidentiality and accuracy.

Leaders in the financial services sector are bullish on AI, with 95% of business and IT decision makers saying that AI is a top C-Suite priority, and 96% of respondents believing it provides their business a competitive advantage, according to Riverbed's Global AI and Digital Experience Survey. Financial services organizations, looking to fend off digital native startups, are pursuing a strategic approach to AI that can reduce costs, increase efficiency, mitigate customer risk and enable customized services.

The industry is also more confident than most sectors in its ability to follow through on widespread AI adoption, with 46% of leaders saying they are fully prepared now to implement their AI strategies, compared with a 37% average across all sectors surveyed. While confidence is high, a majority within the industry are not currently prepared for AI according to the data, revealing a readiness gap in adopting AI, one of three key areas leaders need to address in the year ahead. Leaders in FSI, like those in other sectors, also have a reality gap, with 85% saying they're either "significantly" or "slightly" ahead of their competitors, indicating a level of overconfidence in their own progress. The biggest challenge facing the industry is the data gap, with leaders expressing concerns about both the security of their data and its usability.

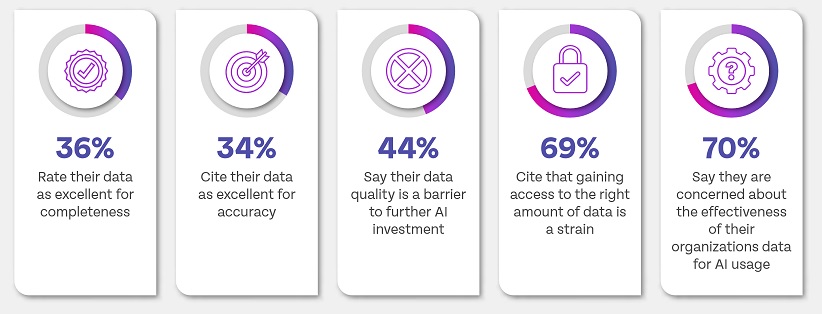

Financial services handle more sensitive customer information than other sectors, and 80% of leaders are worried about the security implications of their data being accessible via the public domain, with their primary concerns being data privacy, regulatory compliance and cybersecurity threats. Despite high confidence in AI's abilities, decision-makers have less faith than those in other sectors in the quality of their data, with only about a third rating their data as excellent for completeness (36%) and accuracy (34%). They need reassurance in data confidentiality and accuracy before they can deliver secure digital experiences for their users, recognizing the need for full-fidelity data.

Younger Employees Are on Board with the Transition

Those concerns notwithstanding, FSI leaders are optimistic about a transformative shift toward AI, with 89% expecting to be fully prepared to implement their AI strategy by 2027 (up from the 46% who say they are ready now). That growth is reflected in their use of generative AI, with 36% saying they have currently implemented or prototyped generative AI, and 71% saying they will in 12 to 18 months.

Leaders say their workforces are mostly enthusiastic about AI, with 62% saying their teams have favorable views (compared with a 59% global average), while only 3% view AI skeptically (compared with 4% globally.) Within their workforces, leaders say Generation Z employees are the most comfortable with AI, at 55%, followed by millennials, at 36%, well ahead of Generation X and baby boomers, at a combined 9%. This suggests AI could eventually replace knowledge-holders; a generational shift in attitudes towards the technology could be why 68% of organizations are increasing investments in infrastructure and talent.

What Financial Service Leaders Expect from Automated AI

Younger generations of workers are also the most insistent about having a positive digital experience, which leaders believe can be improved via AI automation. Last year's survey found that 92% of business and IT leaders in financial services said the need to provide improved DEX for employees and customers would increase pressure on IT resources. However, nearly half (49%) of financial leaders reported that AI implementations have already optimized resource utilization or will do so within three years, and 94% agreed that AI would help deliver a better digital experience for users. By supporting stretched IT teams, AI implementations can help boost morale.

Other key areas that leaders expect AI will improve includes workflow automation (71%), automated remediation (62%) and autonomously offering 24/7 support via tools like chatbots (62%).

As IT decision makers increasingly move into C-Suites — 78% said they have a seat at the table — suggesting IT's critical role in driving business innovation is gaining traction. For example, these leaders say technologies such as AI and unified observability are critical to providing exemplary DEX, with 95% saying that unified observability is important (55% said critically important), and 94% calling for greater investment in unified observability solutions.

The next three years will also see a shift toward using AI to drive growth. Currently, leaders say their primary reasons for adopting AI are split almost evenly between operational efficiencies (51%) and driving growth (49%), but 54% expect fueling business growth to be the focus by 2027, ahead of operations, at 46%.

Finally, the survey found that properly implementing AI tools will be essential to boosting productivity, retaining staff, enabling collaboration and staying competitive in the FSI environment.